As governments around the world prepare recovery packages worth potentially trillions of dollars, the choices they make will impact society and the environment for decades. The breadth of calls for green stimulus show how critical this moment is. Our federal government and central bank rightly prioritized short-term relief, however, the stimulus that comes next should provide a lasting positive impact on our economy and planet.

The key question is what growth do we want to stimulate? Front of mind is improving economic health by strengthening businesses and the infrastructure systems on which they rely. But we also need improved environmental health by drastically lowering carbon emissions and protecting vital ecosystem services. And we must also improve social equity by addressing economic disparities that are tearing at our social fabric and hindering the ability of millions to handle even minor economic shocks. Last but not least, we need to improve our resilience, both for future pandemics and major global warming hazards, such as superstorms, floods, heat waves, and large-scale wildfires.

Funding efforts that have high economic multipliers are important, but to create structural change we must also prioritize projects and programs that will positively impact our climate or provide social benefits. Investors now largely agree that environmental, social, and governance metrics set parameters for better performing investments (e.g., better risk mitigation, equal or higher returns, and lower cost of capital).

The Moving Forward Act recently passed by the House offers an important starting point. While Washington is unlikely to enact this bill or another, wider stimulus bill until after the November election, it contains a number of ideas aligned with our view of impactful stimulus spending, which should be seriously considered by Congress and the White House.

Five key recommendations are outlined below:

1. Address racial and economic inequities through infrastructure investment

2. Make the infrastructure we have last longer

3. Prioritize carbon emission reduction

4. Invest in resilience

5. Create new permanent funding sources

Five goals to shape a better stimulus

1. Address racial and economic inequities through infrastructure investment

Infrastructure and architecture can perpetuate racial and economic injustice. For instance, many of our urban highways, when first built, destroyed black and immigrant neighborhoods, isolated them from centers of employment, and became boundaries for redlining practices. Today, the lack of adequate investment in bus and passenger rail systems disproportionately impacts minorities and the poor.

Stimulus investment in our urban transport systems should be equitable and consider the desired outcomes of those cities and communities. For example, if executed with foresight (i.e., anticipating gentrification pressures), highway removal projects in some cities can lead to wealth creation for the property owners in the neighborhood, help raise taxes for the city, and generally create major economic development opportunities, all of which can create immense value for adjacent residential communities of color historically impacted by highway placements.

Priority should also be given to projects with ambitious, performance-based outcomes that include targets for small and minority-owned business participation. This can be achieved through more meaningful economic incentives or measured economic development successes, as advocated by the New Partnership for Infrastructure, rather than by relying on public procurement processes allotting a percentage of work to small or disadvantaged businesses. Performance-based procurement and contracting is a largely untapped resource for implementing outcomes-based policy and planning and should be considered by government agencies for many reasons, including increased minority participation.

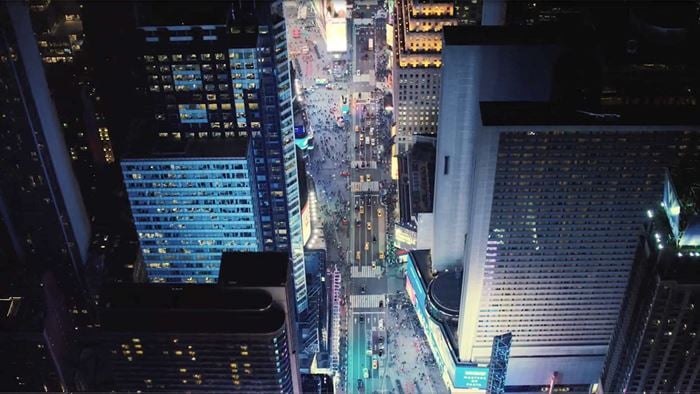

Investing in our urban transit systems not only enables mobility for essential and lower-wage workers but benefits all commuters. These systems are the lifeblood of our largest economic centers. While ridership has been declining in some markets, the systems still buoy land values, enable central business districts to thrive, and attract businesses looking for talent and diversity. Bureau of Economic Analysis data indicates the top 20 metropolitan areas produce around 50% of the United States’ gross domestic product and most of these metro areas are investing in their urban transit systems. Commuter and light rail systems in particular are hurting and require investment to support the next 100 years of mobility.

Senator Markey’s BRAIN TRAIN bill is an example of the kind of serious investment that should be considered by Congress. The transportation bill currently in the House (INVEST Act of 2020) does not adequately invest in passenger rail and could show more commitment to creating a more level playing field for commuters of all economic levels.

2. Make the infrastructure we have last longer

The current US public works funding system encourages the building of new things but is largely indifferent to how we maintain them. Amazingly, budgeting for life-cycle maintenance is rarely considered when planning and building new assets. The serious fiscal challenges this creates for states and cities means we continue to defer maintenance and our public works deteriorate. We spend billions of dollars rebuilding assets before they have reached the end of their design life.

The US will likely aim to build its way out of the problem in the name of job creation and we are already hearing about “shovel-ready” projects. It is right to focus on construction jobs because of the high multiplier effect, but it is a fallacy that we can outpace the deterioration of our current infrastructure with new construction.

Good stimulus should allocate significant funding for public sector maintenance and improving system efficiency. These projects are, by definition, shovel ready. They also accelerate public sector job recovery, reduce deferred maintenance, improve customer experience, and minimize delays due to environmental clearance.

Our urban transit systems are underfunded, aging, and facing unpredictable future ridership trends. Significant investment in these assets and the communities they serve is a direct investment in GDP growth and should therefore be prioritized.

3. Prioritize carbon emission reduction

Achieving net carbon neutrality — to avoid the most disastrous impacts of climate change — is the environmental challenge of our lifetime. Action will be required across all scales, but the big moves, like utility-scale renewables, will rely on a modern power grid. Renewable power generation will continue to increase — wind and solar will make up approximately 35% of total electricity in the US by 2050 — yet its location is largely remote from fossil fuel-based generators. The California wildfires, which have caused trillions of dollars in damage over recent years, clearly demonstrate the vulnerability of our grid and the utilities that own them. Improving grid systems to be smarter and safer is paramount as we move to a future with more electric vehicles, electric transport systems, battery use, microgrids, and distributed generation.

We also need to lower energy demand. Energy efficiency programs are proven to create new jobs, have relatively low barriers to entry for workers, reduce carbon emissions, and positively impact the cost of living for Americans across all income levels. These programs were successful in the last recovery and should be part of the solution this time as well.

4. Invest in resilience

Investing now to minimize possible future costs from a natural hazard is difficult in the private market. Insured losses from US catastrophes since 2000 were $36bn, covering just over half of the total economic losses recorded. Additionally, FEMA, the emergency response agency, is consistently overwhelmed by the impact of larger and more frequent storms and wildfires.

The federal government should focus stimulus investment in adaptation and mitigation projects to limit the loss of life and property from, and reduce the future cost of, natural disasters. This will require a longer-term horizon to capture the return on those investments, which could amount to trillions of dollars saved on future emergencies and create millions of jobs. The National Institute of Building Sciences (NIBS), through funding from FEMA, has been studying investments in hazard mitigation since 2005. Although largely focused on building code improvements, NIBS also studied Economic Development Agency grants for infrastructure improvements and found that for every $1 spent on mitigation for infrastructure, there is a $2–8 return in the future. This type of research is essential to support large-scale federal investments across all regions.

5. Create new permanent funding sources

There is plenty of financing capacity in the capital markets — the bottleneck is cumbersome and antiquated public sector procurement and lack of funding. Federal funding has been declining for almost a decade and will continue to do so. When it comes, the stimulus will be a brief loosening of the federal purse strings, but State and local entities need more dedicated funding for modernizing and repairing our infrastructure.

Water and power utilities (and their customers) need more predictable processes and longer-term periods for rate cases (e.g., raising rates to support investments) and more transparency about what the rate increases are to fund. The two-to-three-year cycles typical of state public utility commissions seem inadequate for longer-term systemic investments. The California Public Utility Commission’s new four-year general rate case cycle is a positive development that provides utilities (and rate payers) more visibility into the future.

For transit networks, better alignment between zoning, infrastructure investment, and value capture techniques can enable continual investment. Promising recent funding actions include transportation sales tax measures and granting passenger rail authorities land use control of their properties.

As information technology becomes more commonplace in the urban environment, our local governments need to prioritize widespread fiber and faster cellular networks and insist on better regulation of data capture, storage, management, analytics, and security. This is important for privacy, but also for harnessing data as currency to fund infrastructure as well as enable the wider adoption of performance-based management in the government sector through data analytics. This area is ripe for public-private partnerships such as the City of Copenhagen – Hitachi data exchange and smart city developments.

Finally, taxation of the digital economy is being seriously considered by the European Union as a source of funding. The US should follow suit.

A major stimulus bill is unlikely until after the November 2020 election, so there is time to evaluate and act on these ideas. As the pressure builds for economic stability, bold climate action, and overdue social reform, we would all benefit from thoughtful stimulus.

;

;